“Ordinary folk who pay council tax end up subsidising these really big developers because councils aren’t allowed by law to charge more money to process their applications.”

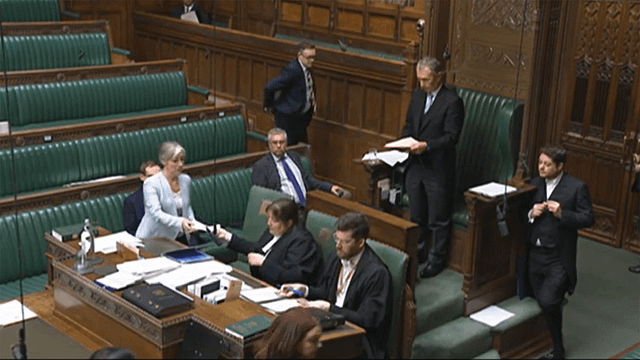

Daisy Cooper, the MP for St Albans, has tabled a bill1 in Parliament to remove the Government-imposed cap on fees that local authorities, such as St Albans District Council, are permitted to charge housing developers to process planning applications.

The Planning Application Fees bill would let councils charge big developers more to cover the cost of processing planning applications to build large housing estates – often resulting in huge profits for these developers.

Currently, local authorities are only allowed by law to charge a flat fee which was last reviewed in 2012. That means it can cost many times more to determine an application than they are allowed to pass on to developers, encouraging speculative applications and putting the council’s planning system under immense strain.

Figures released by the Department for Levelling Up, Housing and Communities2 show that it costs St Albans District Council up to £3,197,000 a year more to process planning applications than is collected in planning fees. For England as a whole, the shortfall is £1.93 billion.

Daisy Cooper MP said:

“We have a huge problem with the national planning system. Fundamentally, it is developer-led not community-led,” says Daisy. “It’s the big developers who choose the pieces of land they want to buy. They decide what kind of houses they want to build that’s going to make them the most amount of money. Then only at that stage, they put in their applications to local authorities.

“These plans are often targeted on green belt land, against the wishes of local people and without the necessary infrastructure in place, such as schools and doctors, to support a much larger community. Not only are councils forced to meet unrealistic government housing targets, but they just don’t have the financial resources or the staff to oversee these developers’ plans with the focus and detail required.”

“In effect, ordinary folk who pay council tax end up subsidising these really big developers because councils aren’t allowed by law to charge more money to process their applications.

“This is at a time when local authorities are really, really, struggling with their finances. The fees just don’t come close to meeting the cost of running their planning services.”

The huge shortfall in revenue also means that councils struggle to keep their planning experts from leaving for the private sector because they can’t pay them enough.

Leader of the District Council and lead councillor on planning, Cllr Chris White, said:

“A lot of these big companies can pay much more money to their senior planners. We’ve got a problem with councils right across the country, where senior planning officers who have the experience to know how to process these applications and work with private developers, are being recruited into the private sector on much higher salaries. The result is that council are left without enough skilled people needed to actually process these applications.”

“The problem we have is that the entire national planning system is broken. It’s a real mess and I really hope the Government addresses it soon. What I would like to see is a community-led planning system that gives a lot more power to local people and local authorities. Removing the cap on fees for developers is a much-needed first step.”

Notes:

1 Text of Planning Application Fees bill: Bill to amend the Town and Country Planning Act 1990 to enable local authorities [in England] to determine the fees to be paid in respect of applications and deemed applications for planning permission; to require local authorities to set the scale of fees with a view to ensuring that the costs of determining applications can be wholly funded by application fees; and for connected purposes.

The bill issupported by Helen Morgan, the Liberal Democrat MP for North Shropshire. It was read for the first time on Wednesday, 16 November, and will have its second reading on Friday, 24 March 2023.

2 DLUHC General Fund Revenue Account Outturn.